Many Central Oregonians are at or near retirement and about to turn their 401(k)’s and IRA’s into an income stream. I refer to this as “The Fragile Risk Zone” as retirement contributions come to a halt and distributions begin. They will be dependent on living off these proceeds over the next few decades. They have worked their entire careers to accumulate these funds and there are no second chances.

Many Central Oregonians are at or near retirement and about to turn their 401(k)’s and IRA’s into an income stream. I refer to this as “The Fragile Risk Zone” as retirement contributions come to a halt and distributions begin. They will be dependent on living off these proceeds over the next few decades. They have worked their entire careers to accumulate these funds and there are no second chances.

What do you think is more important to investors at this stage of their lives, rate of return or order of return? Most believe rate of return. I stress that order of returns (also known as sequence of returns) is every bit as important as rate of return. I will even go as far as saying that it is potentially the biggest risk one will face in their years of financial independence. I find most successful investors are unaware of this unknown hazard!

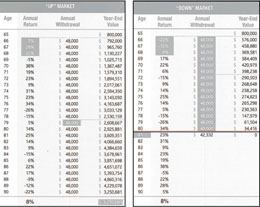

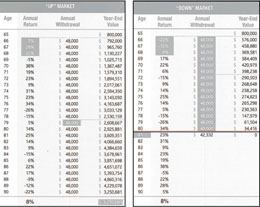

Consider the two charts below. I consider the investor represented by the left chart to be the “lucky investor” and the investor to the right the “unlucky investor”. Both share a great deal of similarities. They are 65 years of age and have account balances of $800,000 that are experiencing an eight percent average rate of return. They are each taking a six percent annual withdrawal (six percent of $800,000 = $48,000). One would think they would have the same chance for a successful retirement and yet the lucky investor is able to grow his account value significantly over time while taking his six percent withdrawals each year and the unlucky investor is broke just part way through retirement. How can this be? What is the difference?

The only difference between Chart one and Chart two is the sequence of the retuns. I illustrated the returns using the exact same numbers but just reversed their order. Where the lucky investor began his retirement with positive rates of return: five percent, 28 percent and 22 percent, the unlucky investor experienced these same returns at the end of his life. Where the unlucky investor begain his retirement with three negaitive years of returns; -22 percent, -12 percent and -9 percent the lucky investor experienced these same returns at the end of his life. This illustrates the dramatic impact of early negative market performance. As if market risk isn’t enough of a challenge in retirement planning, when one experiences gains or losses, their sequence of returns can have a significant impact on your retirement assets. It can mean the difference between having enough income in retirement or running out of money too soon.

What should you take away from this? When planning for your years of financial independence understand that using historical averages is misleading when looked at alone. Even though a portfolio may return above-average numbers, consideration must be given to when those returns took place. Be careful when an analysis states you should achieve your goals by obtaining a specific rate of return. In most cases it has not taken in to account the sequence of returns.

When the financial crisis hit many investors were devastated by crushing blows to their retirement accounts. People are exhausted and emotionally frustrated. Unfortunately many are immobilized and doing nothing. We are sitting down with our clients to reassess their income capabilities and their goals to determine if they are still achievable. It’s not luck that enables people to retire, travel, and enjoy themselves. It is planning. Today, retirement planning should involve more than investment decisions. A comprehensive plan encompasses developing strategies to maintain purchasing power in the face of inflation, ensuring you are diversified among asset classes as well as investment companies and learning ways to protect yourself from the potential of a harmful sequence of investment returns.

David Rosell is President of the Rosell Wealth Management in Bend. He is the President of the City Club of Central Oregon and the Past Chairman of the Bend Chamber of Commerce. David can be reached at (541)385-8831 or our brand new web site: www.RosellWealthManagement.com.

Investment advisory services offered through Rosell Wealth Management, a State Registered Investment Advisor. Securities offered through ValMark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste 300 Akron, Ohio 44333-2431. 800 765-5201. Rosell Wealth Management is a separate entity from ValMark Securities, Inc.